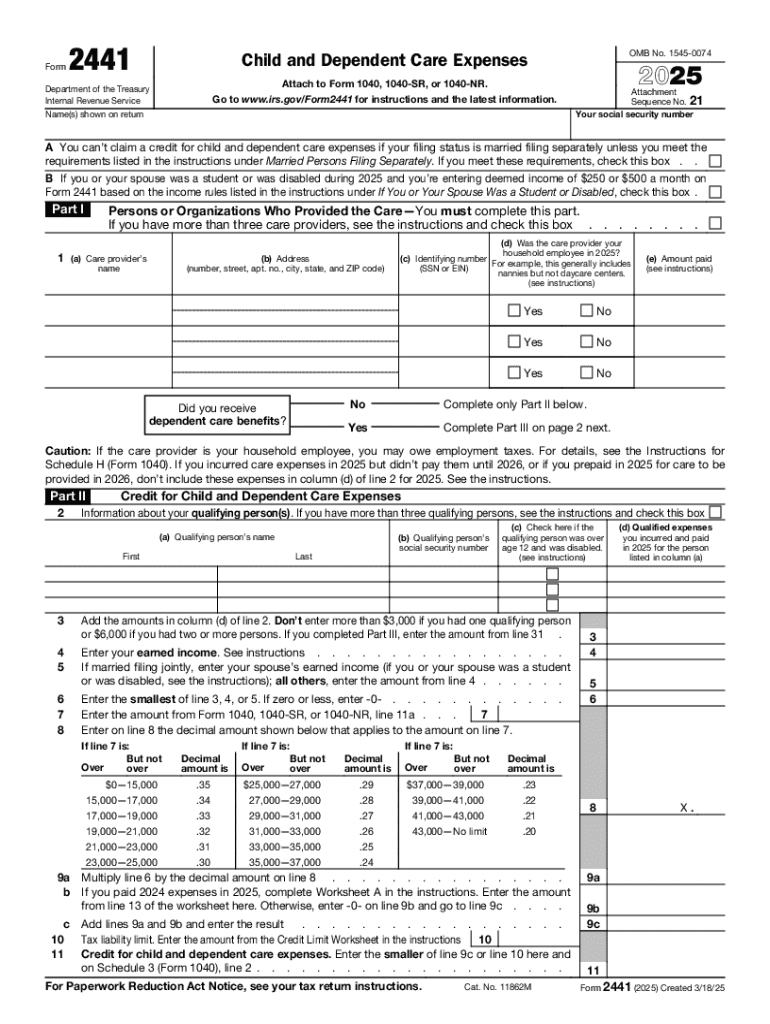

IRS 2441 2025-2026 free printable template

Instructions and Help about IRS 2441

How to edit IRS 2441

How to fill out IRS 2441

Latest updates to IRS 2441

All You Need to Know About IRS 2441

What is IRS 2441?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 2441

What should I do if I realize I made a mistake on my IRS 2441 after filing?

If you've discovered an error on your IRS 2441 after submission, you should file an amended return using Form 1040-X. This allows you to correct any mistakes. Be sure to include the amended IRS 2441 with your 1040-X and clearly indicate the changes made.

How can I check the status of my submitted IRS 2441?

To verify the status of your submitted IRS 2441, visit the IRS website and utilize the 'Where’s My Refund?' tool, which can provide updates on your filing status. Additionally, keep an eye out for confirmation emails if you e-filed or notification from the IRS if you've mailed a paper form.

Are there common errors people make when filling out the IRS 2441?

Yes, common errors on the IRS 2441 include incorrect Social Security numbers, miscalculating credits, or failing to include all necessary information. To avoid these mistakes, double-check all entries and ensure compliance with the latest guidelines before submission.

What should I do if my IRS 2441 submission is rejected e-filed?

If your IRS 2441 e-file submission is rejected, review the rejection codes provided by your e-filing software for specific issues. Correct the identified errors and resubmit the form as soon as possible to ensure that your tax situation remains compliant.

How long should I keep my records related to the IRS 2441?

It's recommended to retain your records related to the IRS 2441 for at least three years from the date of filing. This includes any supporting documentation for expenses claimed, as the IRS may request evidence if your return is selected for audit.

See what our users say