IRS 2441 2024-2025 free printable template

Show details

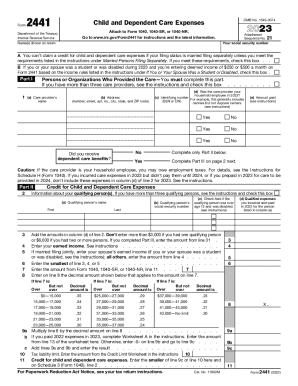

9a 9b 9c Form 2441 2024 Page 2 Dependent Care Benefits Enter the total amount of dependent care benefits you received in 2024. If you meet these requirements check this box. B If you or your spouse was a student or was disabled during 2024 and you re entering deemed income of 250 or 500 a month on Form 2441 based on the income rules listed in the instructions under If You or Your Spouse Was a Student or Disabled check this box. However don t enter more than the maximum amount allowed under...

pdfFiller is not affiliated with IRS

Understanding IRS Form 2441: A Comprehensive Guide

Detailed Steps for Modifying Your Submission

How to Complete IRS Form 2441

Understanding IRS Form 2441: A Comprehensive Guide

IRS Form 2441, titled the "Child and Dependent Care Expenses," is essential for taxpayers seeking tax credits for care expenses related to children or dependents. This guide will help you navigate the complexities of IRS 2441, ensuring you understand when and how to use it effectively.

Detailed Steps for Modifying Your Submission

Modifying your IRS 2441 submission involves clear steps that ensure compliance and accuracy. Follow these steps to make effective edits:

01

Review original submission for any errors or omissions.

02

Make necessary adjustments directly on the form – ensure all changes are clearly marked and legible.

03

Double-check that your revised figures align accurately with provided documentation.

04

Consult IRS guidelines to ensure updates adhere to the current regulations.

05

Save and submit the revised form, keeping a copy for your records.

How to Complete IRS Form 2441

Filling out IRS Form 2441 effectively is crucial to secure tax credits. Consider these steps:

01

Gather necessary documents, such as receipts for childcare expenses and your tax return.

02

Enter your personal information, including your name and Social Security number.

03

Indicate the number of qualifying persons—this could be your child under 13 or a dependent who is unable to care for themselves.

04

Detail your care expenses in the appropriate sections, categorizing them by type and duration.

05

Calculate your credit based on the eligible expenses listed, ensuring all amounts align with IRS guidelines.

Show more

Show less

Recent Changes and Updates to IRS Form 2441

Recent Changes and Updates to IRS Form 2441

This year, significant updates to IRS Form 2441 include adjusted income thresholds for eligibility and a shift in the documentation requirements for claiming expenses. It's essential to stay informed about these changes to maximize your claim effectively.

Essential Insights into IRS Form 2441

What is IRS 2441?

The Purpose of IRS 2441

Who Needs to Complete This Form?

When is the Exemption Applicable?

Components of IRS Form 2441

Filing Deadline for IRS Form 2441

Comparative Analysis with Similar Forms

Covered Transactions Under IRS Form 2441

Required Copies for Submission

Penalties for Non-Compliance with IRS Form 2441

Information Required for IRS Form 2441 Submission

Other Forms That Accompany IRS Form 2441

Submission Address for IRS Form 2441

Essential Insights into IRS Form 2441

What is IRS 2441?

IRS Form 2441 is designed for taxpayers to claim a credit for expenses incurred for the care of children or qualify for a dependent who cannot care for themselves. This form is vital for reducing your total tax liability based on these expenses.

The Purpose of IRS 2441

The primary purpose of IRS Form 2441 is to enable taxpayers to obtain tax credit for qualifying child and dependent care expenses. This tax benefit can significantly alleviate the financial burden of childcare, allowing families to work or seek employment while ensuring their dependents are cared for.

Who Needs to Complete This Form?

Taxpayers with children under 13 or dependents unable to care for themselves and who incurred daycare expenses must complete IRS Form 2441. This form applies to various scenarios, including parents working full-time, single parents, and families needing to utilize childcare services to pursue education.

When is the Exemption Applicable?

The exemption for filing IRS Form 2441 applies under various criteria, including specific income thresholds and the nature of the care provided. For example, taxpayers whose adjusted gross income (AGI) does not exceed $438,000 for joint filers can qualify for maximum credits.

Components of IRS Form 2441

IRS Form 2441 has several key components:

01

Personal information section, detailing taxpayer’s identity and dependent information.

02

Expenses section, where taxpayers will itemize qualifying care expenses.

03

Credit calculation section, assisting in determining the applicable tax credits.

Filing Deadline for IRS Form 2441

The filing deadline for IRS Form 2441 mirrors the standard tax return due date, typically April 15th of each year. However, if additional time is needed, you can file for an extension, pushing the deadline to October 15th. Always ensure timely submission to avoid penalties.

Comparative Analysis with Similar Forms

IRS Form 2441 can often be compared to forms like IRS Form 8862 (Application for Certificate of No Wrongful Claim) that address similar credits or deductions. However, IRS Form 2441 specifically targets childcare expenses, making its requirements and intended audience distinct.

Covered Transactions Under IRS Form 2441

This form specifically covers expenses related to care incurred for children under 13 or eligible dependents. For example, payments to daycare facilities or in-home care services qualify, while expenses for schooling or overnight camps do not fall under this category.

Required Copies for Submission

Submitting IRS Form 2441 typically requires only one original copy, which is attached to your federal tax return. However, retaining additional copies for your records may be beneficial in case of review or audits by the IRS.

Penalties for Non-Compliance with IRS Form 2441

Failing to submit IRS Form 2441 or providing inaccurate information can result in several penalties, including:

01

Fines ranging from $50 to $100 depending on the nature of the error.

02

Potential disqualification from claiming child and dependent care credits in future tax years.

03

In severe cases, legal repercussions could arise for statements made with fraudulent intent.

Information Required for IRS Form 2441 Submission

To accurately fill out IRS Form 2441, ensure you have the following information on hand:

01

Your Social Security number and that of your dependents.

02

Total amount spent on qualifying care throughout the tax year.

03

Records proving payment (receipts, bank statements, etc.).

Other Forms That Accompany IRS Form 2441

While IRS Form 2441 is typically standalone, it may need to be submitted alongside Form 1040 as part of your complete tax package. Be sure to check if additional forms are necessary based on your unique tax situation to ensure compliance.

Submission Address for IRS Form 2441

IRS Form 2441 should be sent to the address specified for your area based on the IRS instructions included with your tax return form. Typically, the submission addresses are located on the IRS website and can change from year to year, so always verify before sending.

By understanding IRS Form 2441 and diligently following this guide, you can maximize your tax benefits. If you have further questions or need assistance with your forms, do not hesitate to seek professional help in tax preparation or utilize tax software today.

Show more

Show less

Try Risk Free